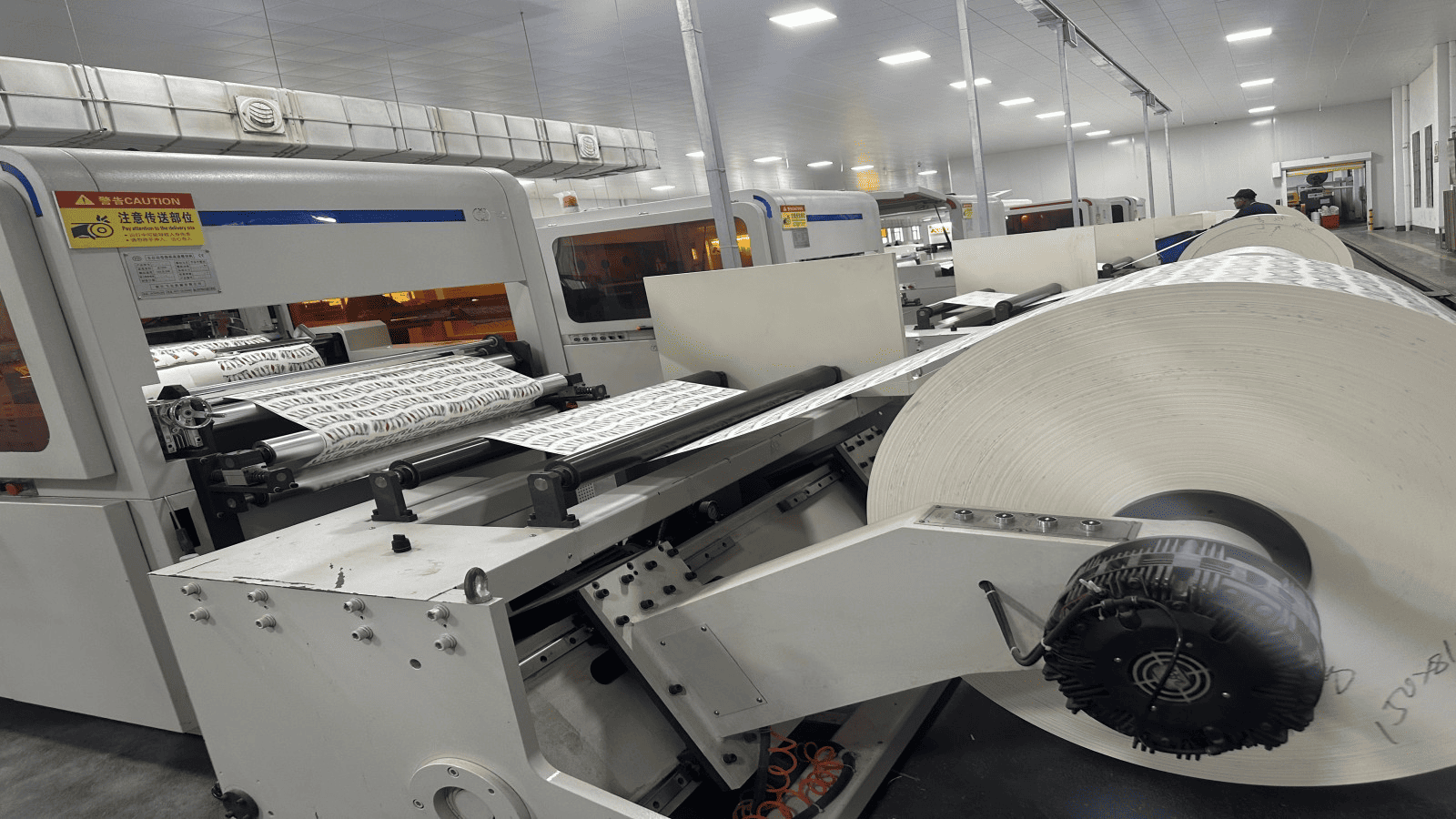

The paper industry in 2025 is moving from price wars to capacity control, but raw material cost changes1 are already reshaping the paper cup market2.

The industry’s “anti-internal competition” move signals a shift to controlled production and quality improvement, but rising material costs could still push paper cup prices higher.

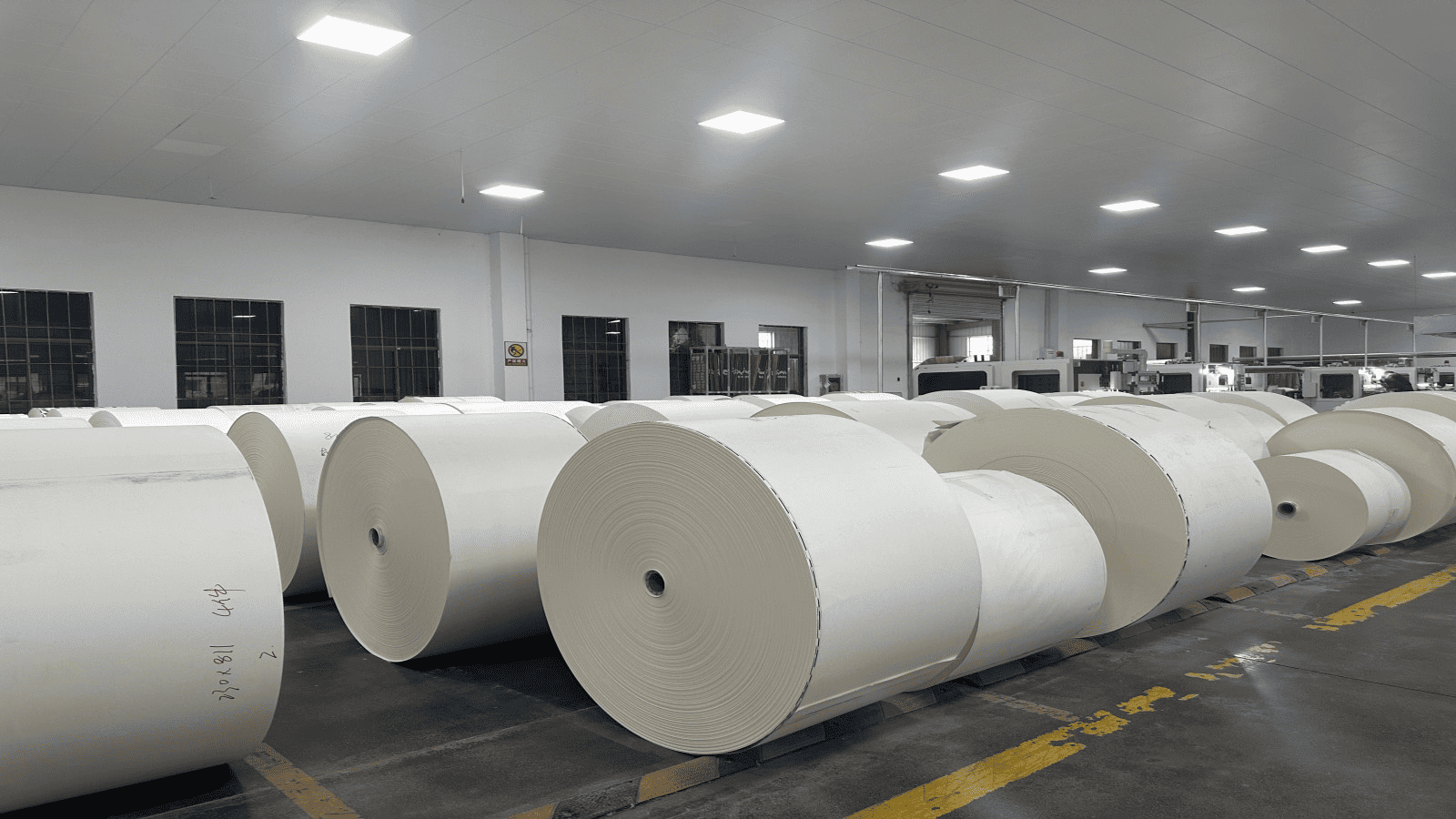

I have already seen upstream paper mills raising prices, which has quickly affected packaging and paper cup manufacturers down the line.

The Impact of Raw Material Price Hikes on the Paper Cup Industry?

When the price of core paper materials increases, every player in the paper cup supply chain feels the pressure.

Higher raw paper and PE/PLA3 film prices raise production costs, squeeze profits, and can lead to changes in quality and market concentration.

I have personally experienced how even a ¥30/ton increase in base paper can quickly translate into thousands of yuan in additional monthly costs for factories.

Five Main Effects of Rising Material Prices

| Effect | What It Means |

|---|---|

| Production cost up | Directly raises per cup cost |

| Retail price increase | Manufacturers may pass cost to customers |

| Quality risk | Some switch to lower-grade materials |

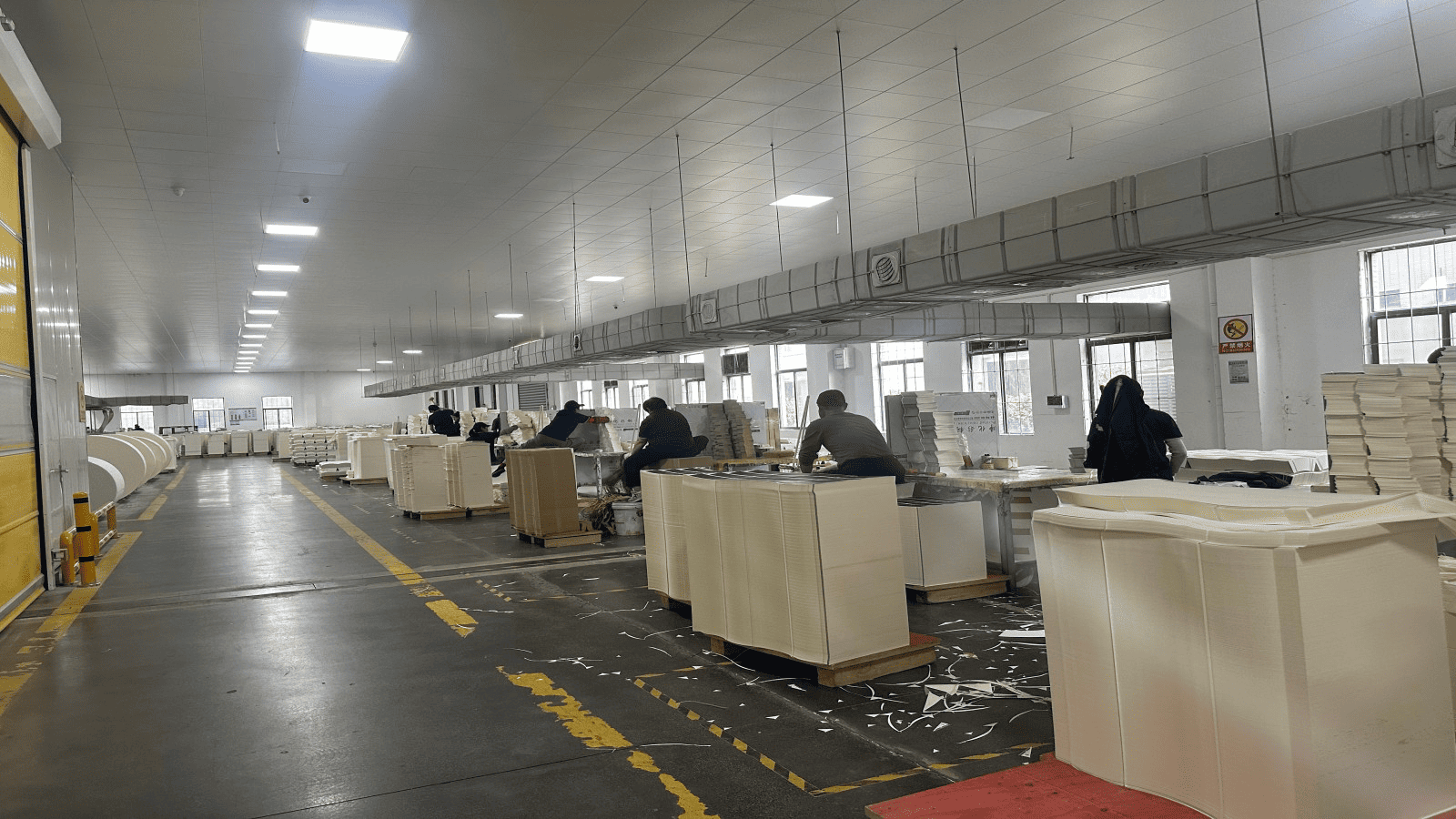

| Profit squeeze | Smaller factories struggle to maintain margin |

| Market shake-up | Larger players absorb shock; weaker ones may close or merge |

The Trend of Paper Price4s in 2025?

Paper prices in 2025 are diverging by category, but food packaging5-grade white card paper is seeing steady upward pressure.

White card paper prices are likely to climb moderately before year-end, with limited room for decline due to capacity control and seasonal demand.

I follow pulp and paper price trends closely, and I see packaging paper benefiting from strong seasonal consumption alongside controlled production.

2025 Paper Category Trends

| Paper Type | Short-term Forecast |

|---|---|

| Cultural paper | Rising steadily due to high seasonal demand and pulp recovery |

| Packaging paper | Prices stable to slightly higher; demand caps sharp increases |

| Tissue paper | Low compared to 2024 but slowly rebounding |

| White card paper | Gradual increase toward year-end; limited downside |

Do We Need to Submit the Paper Cup Purchase Plan for the End of the Year in Advance?

Yes, because both cost and logistics pressures will likely increase toward the year-end peak season.

Locking in paper cup orders6 in Oct–Nov can secure lower costs and stable delivery before year-end demand peaks.

In my experience, delaying to December risks both price hikes and late deliveries due to bottlenecks in production and shipping.

Suggested Procurement Steps

- Bulk buyers: Lock orders by October or November

- Smaller buyers: Watch for November price changes but keep 2–3 weeks lead time

- All buyers: Ensure stock covers festival and holiday needs

Suggestions for Selecting Cup Sizes?

Choosing the right size can increase customer satisfaction and reduce waste in daily operations.

Match cup size to the beverage or dessert type, considering capacity, wall thickness, and lid compatibility for the best user experience.

I always recommend balancing unit cost with functionality—oversized cups may increase waste, while undersized ones reduce customer satisfaction.

Practical Cup Size Guide

| Scenario | Volume Range | Recommendation |

|---|---|---|

| Daily water/office | 220–300 ml | Standard single-wall cups |

| Hot drinks | 350–450 ml | Double-wall or extra thick walls for heat |

| Cold drinks | 500–700 ml | With lids and straws, ideal for delivery |

| Children’s drinks | 150–200 ml | Small diameter, spill-preventing design |

Extra Tip: Check rim diameter compatibility with lids and straws. Large hot drink cups should have bottom diameter ≥6cm and paper weight ≥280g for stability.

Conclusion

In 2025, with raw material costs climbing and production controls in place, acting early on procurement and paying attention to cup sizing will help maintain both cost stability and product quality.

1.Understanding these effects can help businesses adapt to market fluctuations and maintain profitability. ↩

2.Exploring the latest trends in the paper cup market can provide insights for manufacturers and buyers alike. ↩

3.Learn how PE and PLA coatings impact paper cup quality, cost, and environmental footprint to make informed sourcing decisions. ↩

4.Stay ahead in procurement planning by understanding 2025 paper price trends and forecasts to better manage costs and supply chain risks. ↩

5.Discover the latest food packaging trends and innovations to stay ahead in design, sustainability, and cost efficiency for your business. ↩

6.Learn the optimal timing for placing paper cup orders to avoid price hikes and ensure timely delivery during peak demand seasons. ↩